CCH iKnow for Bookkeepers and BAS Agents is a cost effective and unique offering integrating bookkeeping tools and essentials with practical accounting, taxation, GST and FBT content. Delivered via an award winning online research platform, CCH iKnow, and designed in collaboration with Australian bookkeepers, it is designed to save you time and drive efficiencies – no matter how small or large your bookkeeping practice is.

As the trusted adviser of small business and partner to accounting firms, the content and tools will help you apply taxation rules and rates confidently, and brand new GST, deductions and depreciation lookup tools will get you the answers you need quickly, without needing to access multiple sources.

More than 5 staff members? Contact us to speak with a solutions manager about the options for your firm.

Bookkeeping Packages

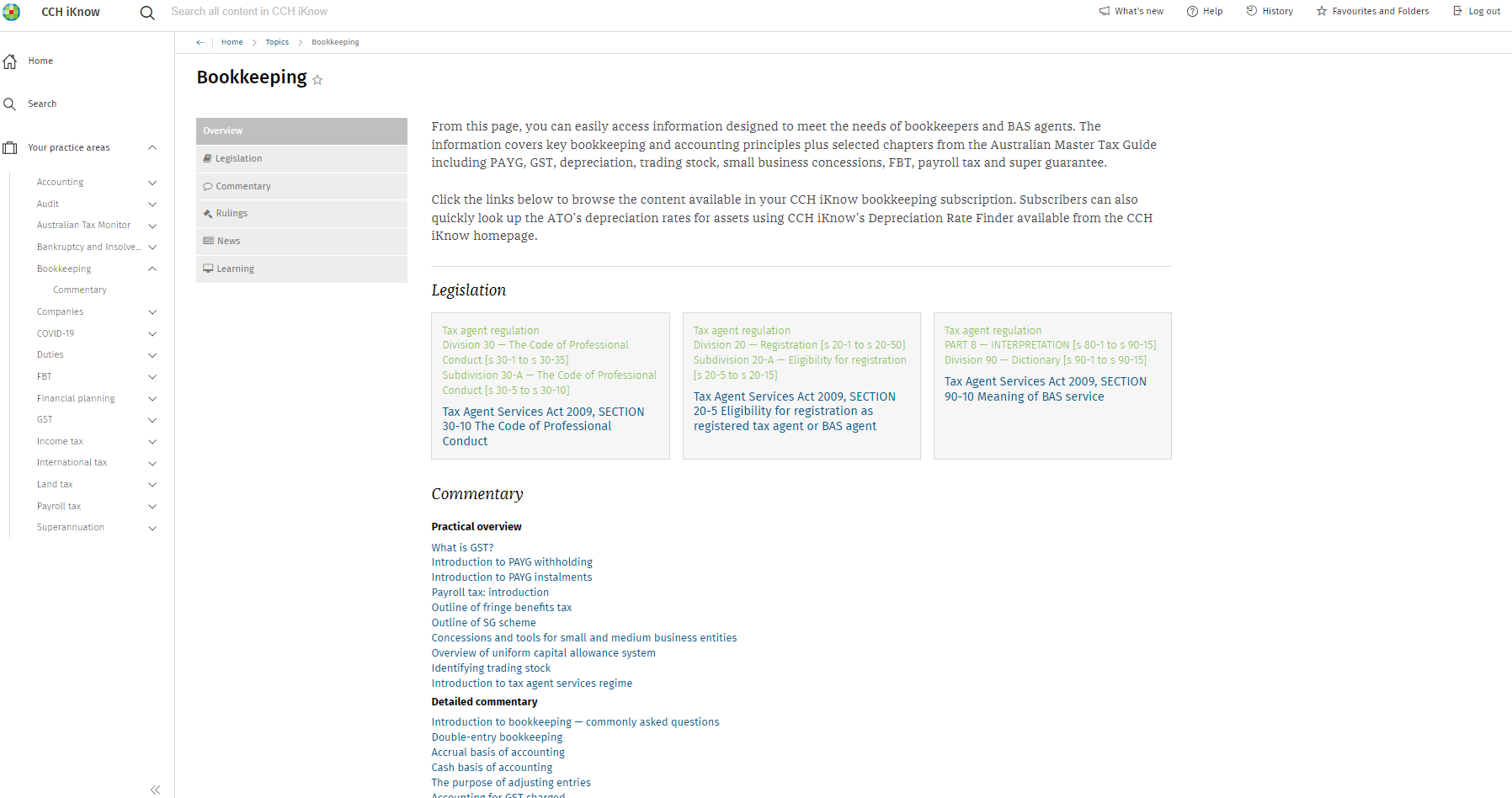

All packages include access to content via, CCH iKnow, the industry’s most valuable resource for today’s bookkeeping and BAS professionals. With all the comprehensive, up-to-date and in-depth content you’ll ever need – curated by Wolters Kluwer experts, always presenting the latest practical content, commentary, legislation and rulings.

What's Included

Practical Bookkeeper’s Guide

Bookkeeper Essentials

Bookkeeper Plus

Content includes:

- Introduction to bookkeeping

- Recording transactions

- Adjusting entries and preparation of the financial statements

- Accounting for GST

- Accounting for cash, debtors and creditors

- Accounting for inventory

- Accounting for non-current assets

- Financial statement analysis

Depreciation Rate Finder

Bookkeeping Topic Guide

Legislation and Source material

Plus selected material from the Australian Master Tax Guide:

- PAYG withholding

- PAYG instalments

- Tax agents and BAS agents

- GST

- Payroll tax

- Small Business Entities

- Tax Accounting

- Trading Stock

- Depreciating Assets

- Fringe Benefits Tax

- Superannuation Guarantee Charge

Everything from the Practical Bookkeeper’s Guide plus access to CCH iKnow Practical Tools - 600+ procedures, checklists, calculators and workpapers covering:

Year End

Expert resources to help you calculate, prepare financial statements and tax returns, as well as quickly and easily determine the financial position of your clients.

Special Transactions

Ensure accurate and efficient treatment of complex transactions including GST, capital gains, FBT, small businesses, Div 7A and many more.

Client Management

A wealth of tools and procedures to help you manage your client’s lifecycle. From onboarding new clients to dealing with customer complaints.

Practice Management

The nuts and bolts of how your practice is run directly affect your productivity and profitability. Use these systems and processes to ensure your practice runs smoothly

Everything from Bookkeeper Essentials plus the full, updating Australian Master Tax Guide.

Comparison Guide

Practical Bookkeeper’s Guide

Bookkeeper Essentials

Bookkeeper Plus

Updating Practical Bookkeeper’s Guide

✓

✓

✓

Practical Tools hub – 600+ tools across tax year end, special transactions, client management and practice management

X

✓

✓

Updating Australian Master Tax Guide

Selected material including information on PAYG, GST, Payroll tax, FBT etc

Selected material including information on PAYG, GST, Payroll tax, FBT etc

All fully searchable 45 chapters and related material.

All source material, legislation, rulings, cases

✓

✓

✓

News

✓

✓

✓

Access to the content via the award winning CCH iKnow research platform, designed in Australia for Australian professionals

✓

✓

✓